Gina Castro June 1st, 2023

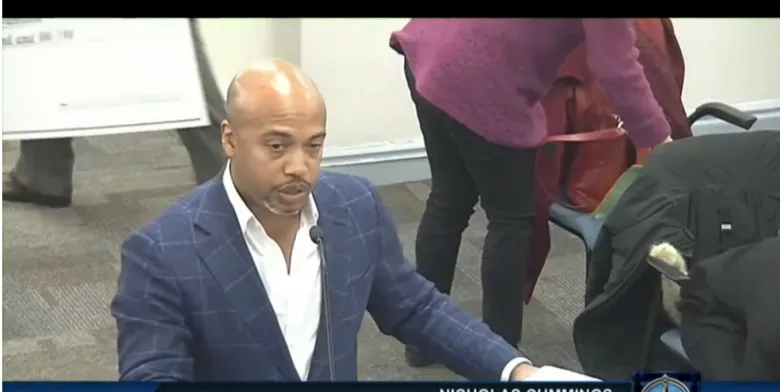

The city is confident the federal Internal Revenue Service won’t take a cut of an individual’s cash reparations payment for taxes, but isn’t as certain about the state government’s perspective, according to Corporation Counsel Nicholas Cummings.

To ensure that Illinois takes the same point of view, Cummings recommended the city seek legislative action.

The federal government’s definition of “income” excludes restitution, repair for injury or loss, which means restitution isn’t taxable, Cummings explained to Reparations Committee members during their June 1 meeting.

“We are confident that the IRS will not consider these payments as income,” Cummings said.

The issue is if the Illinois state government interprets restitution as income.

“According to the definition, set out by the public aid code, there is some concern, our tax attorney would not give us definitive advice on this, that the state could view these payments as income or as money received,” Cummings said. “That would put in danger those who are recipients of SNAP, TANF, Medicaid and those sort of entitlement benefits.”

State-run assistance programs, like SNAP (Supplemental Assistance Nutrition Program), TANF (Temporary Assistance for Needy Families) and Medicaid have income limitations. If the reparations grant is considered income in Illinois, then people who receive funds from state programs could be disqualified for having too high an income.

Seeking outside advice

The city’s law department sought advice from a tax attorney, whom Cummings didn’t name, to identify a route for recipients of the reparations program to avoid paying taxes on their grants. The City Council amended the program in March to include direct cash payment as an option for using the grant. Recipients would be at risk of being required to pay taxes on the grants only if they select cash payment.

Cummings recommended taking a legislative route. The Illinois public aid code was amended once before to pay restitution to Japanese Americans for forcing them into internment camps during World War II, Cummings said.

“We need to have action in Springfield because the public aid code already exempts payments to Japanese Americans under the Civil Liberties Act 1988,” Cummings said. “It is explicit in the Illinois public aid code that we do not count these payments of restitution. So I don’t understand why we couldn’t get similar language in the public aid code.”

Mayor Daniel Biss is on board to support amending the public aid code and Cummings told the governor ‘s office about the idea, too, he said.

Robin Rue Simmons, chair of the Reparations Committee, added that the governor’s office should support this amendment because it made its own commitment to reparations. The state formed the African Descent-Citizens Reparations Commission in September 2022.

“I hope the state is considering this a priority,” Rue Simmons said. “This is programming and decisions that they’ll need in other communities as cash payment becomes more popular [type of] reparations.”

Other solutions

The Reparations Committee tossed out several shortcuts for getting grant recipients cash payment ASAP without paying taxes. Rue Simmons recommended allowing grant recipients to receive payments of reparations over a multi-year timeframe at a certain amount that still meets the income requirements of state-run assistance programs. Committee members Bonnie Lockhart and Krissie Harris supported Rue Simmons.

The seven-person committee, which includes three members of the City Council, did not have a quorum at its June 1 meeting, so it wasn’t able to vote or make decisions on potential solutions.

Cash payments and mortgage assistance are the fastest options for disbursing grants. Committee members showed support for going out of order of the list of recipients in order to disburse grants quickly.

Audrey Thompson, director of the Parks and Recreation Department, is working with Tasheik Kerr, assistant to the city manager, and two city interns to interview all ancestors and descendants waiting for their grants. The city is using this process to determine what options recipients want. The home improvement option takes the longest to complete because Community Partners for Affordable Housing (CPAH), which functions as the program’s administrator, is able to do only one home renovation project a month.

Thompson clarified that grant recipients can split the ways they choose to spend the grant among multiple options. For example, some of the first 14 to receive their grants still have a remaining balance, so they can choose to receive the remaining option in the form of cash.

Carlis Sutton, another committee member, asked Cummings about distributing cash payment as a forgiveable loan. The city has made this type of loan for businesses restoring their storefronts, Sutton explained. Cummings said he’ll look into this option.

It’s still unclear if the direct cash option would avoid taxes, but the city plans to make the risk very clear to grant recipients.

“The [reparations program] form has been updated to inform the public of this risk,” Cummings said. “It’s sort of you choose at your own peril. If you want the full cash payment, there is that risk.”